It looks like you are on the global version of the Tetherfi website.

Visit Our US WebsiteVideo experiences within any mobile, web or desktop application.

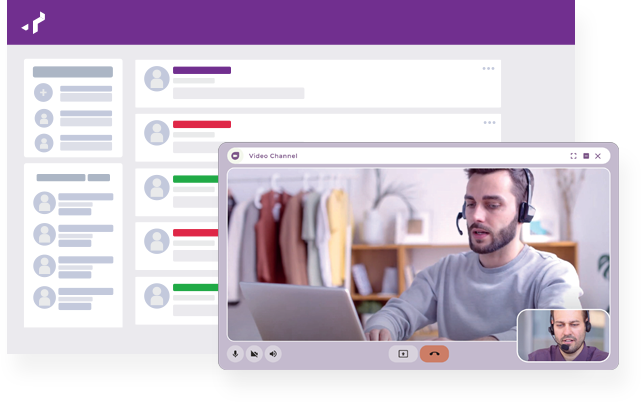

Enable Live-video calls with agents within existing applications & channels

Works natively on browsers and native/ react native apps without downloads

Offer an alternative to in-person interaction with minimal friction & maximum interaction

Enable agents to handle video calls within their desktop along with voice calls

Works both standalone or integrated with PABX

Deploy on-premise, in the cloud or hybrid cloud depending on needs

End-to-end encryption between terminating entities for both data-in-motion and data-in-rest

Route video calls based on business rules, integrate with PABX to enable agents to handle voice & video

VP9 & Opus codecs for better compression. Tested in 100+ browsers and works flawlessly on both native and hybrid apps

Talk to us to know how Tetherfi can elevate your customer &

employee experience without ripping and replacing your

existing infrastructure.

Embrace the future and join our growing community.

Please provide your name and email address for your free download.

We care about your data, and we’d love to use cookies to make your experience better.